A Story of Realizing That Hard Work Isn’t Enough Without Financial Education

The Awakening

For the longest time, I truly believed that hard work was the ultimate answer to success.

Like most Filipinos, I was raised to think that if I just studied hard, got a stable job, and kept my head down, everything else would eventually fall into place.

And for a while, that belief carried me through life.

I worked as much as I could. I accepted overtime. I took double shifts when needed. I sent money to my family, helped relatives, and treated friends every payday because it felt good to be generous.

But one quiet evening, as I was about to pay my bills online, something inside me stopped. I checked my balance, and my heart sank.

After all these years of working, I realized — I still had nothing to show for it.

Not even a small emergency fund.

No investments.

No insurance.

Just a wallet that kept getting refilled and emptied every 15th and 30th of the month.

I wasn’t lazy. I wasn’t careless. But I was financially blind.

That moment changed everything for me. It was the start of a painful but necessary awakening.

The Harsh Reality of the Hardworking Filipino

I later found out that my story wasn’t unique. In fact, it was heartbreakingly common.

So many hardworking Filipinos, both here and abroad, give everything they have to their jobs — yet remain stuck in the same financial cycle.

Here are a few realities that opened my eyes:

| Common Situation | Hidden Reason | Result |

| Earns monthly but always broke | No clear budgeting or savings habit | Paycheck-to-paycheck cycle |

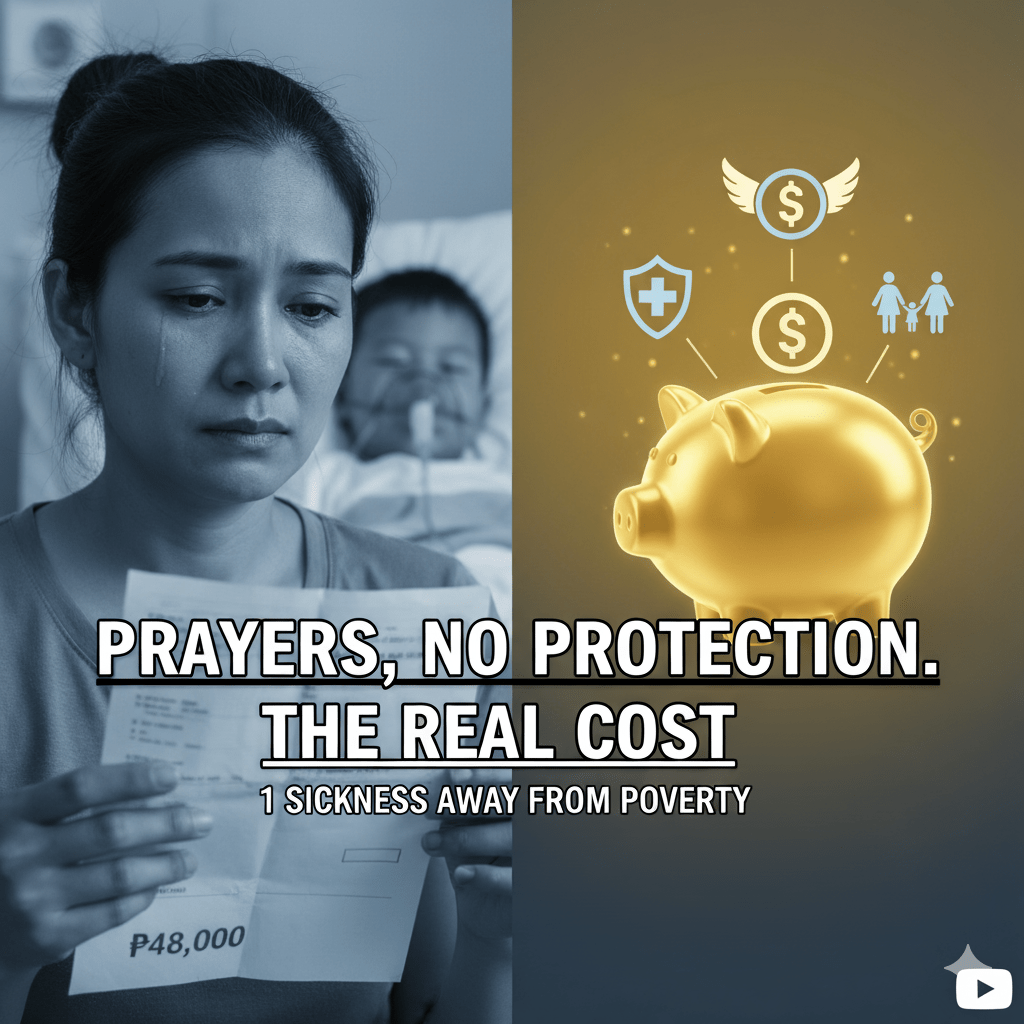

| Supports family but no protection | No healthcare or life insurance | Financial collapse during emergencies |

| Has income but no investments | Fear or lack of financial education | Money never grows |

| Works abroad for years | No financial plan back home | Returns home with little to show |

| Focuses only on earning | No wealth-building mindset | Lifetime of working without freedom |

These patterns aren’t caused by laziness or lack of discipline. They’re caused by financial illiteracy — the lack of understanding of how money actually works.

We’re taught how to earn, but never how to manage or grow what we earn.

The Illusion of Progress

Every payday, I felt a short-lived sense of accomplishment. The moment the salary came in, I’d pay bills, buy groceries, treat myself to something small, and maybe send money home.

By the end of the week, the money was gone again.

And then I’d say, “It’s okay, next month will be better.”

But next month came — and nothing changed.

I convinced myself that I just needed to earn more. Maybe if I got promoted or took on extra work, I’d finally have enough to save.

But here’s the truth: it’s not about how much you earn; it’s about how you manage what you earn.

Even if you earn more, if your habits remain the same, the result will also remain the same.

The Turning Point

Everything shifted when a close friend asked me a question that hit like a brick:

“Do you know where your money goes every month?”

I laughed and said, “Of course!” But deep down, I didn’t.

So, for the first time, I tracked my spending for an entire month.

What I found shocked me.

Small, daily expenses were eating away at my income — coffee, delivery fees, online subscriptions, random gadgets. And because I didn’t have a plan, I was unconsciously prioritizing wants over needs.

I was spending without direction.

That’s when I realized: I wasn’t just broke because of my income. I was broke because I lacked a system.

The Eye-Opening Discovery

That’s when I discovered the International Marketing Group (IMG).

It started with a single invitation — “Attend this financial literacy seminar; it will change the way you see money.”

At first, I was skeptical. I thought it was just another sales talk or investment pitch. But the speaker said something that cut through my doubt:

“It’s not about how much you earn; it’s about how much you keep, protect, and grow.”

For the first time, I realized the missing piece in my life wasn’t effort — it was education.

IMG wasn’t just selling a product. It was offering a mindset shift.

They taught concepts that I never learned in school or at work — principles that the rich have been practicing quietly for decades.

Lessons That Changed Everything

Here are some of the most powerful lessons I learned through IMG:

| Lesson | What It Changed |

| Pay Yourself First | Instead of saving what’s left, I began saving before spending. This one habit changed my entire financial direction. |

| Protect First Before You Invest | I learned that insurance and healthcare aren’t expenses — they’re shields. Without them, one emergency can erase everything you’ve built. |

| Build Multiple Sources of Income | I stopped depending on one job. I learned how to let my money earn even when I wasn’t working. |

| Understand How Money Grows | I discovered the power of compound interest and how time is either your best friend or worst enemy when it comes to investing. |

| Be Part of a Financial Community | The environment changed me. When you surround yourself with people who value growth, you grow too. |

These lessons were practical, simple, and life-changing. They gave me structure, clarity, and most of all — hope.

The Problem with Our Culture

Many Filipinos are afraid to talk about money.

We’re told it’s rude, uncomfortable, or even greedy. But the result of that silence is devastating — generations that work hard but never build wealth.

We celebrate people who sacrifice for their families, but we don’t teach them how to protect the fruits of their sacrifice.

We admire OFWs who send money home, but we don’t guide them in building something sustainable.

We’re proud of breadwinners, but we never teach them how to stop the cycle of debt and dependency.

The truth is, we need to change that narrative.

Financial education should not be a luxury. It should be a necessity — as essential as learning how to read and write.

The Emotional Cost of Financial Ignorance

Beyond the numbers, there’s a deeper emotional toll that comes with being financially unprepared.

It’s the stress of living paycheck to paycheck.

The fear of getting sick and not being able to afford hospitalization.

The guilt of saying no to your child’s needs.

The quiet shame of borrowing money again, promising it’s the last time.

These emotions drain you, little by little, until you begin to accept financial struggle as your “normal.”

But it doesn’t have to be that way.

The Path to Financial Freedom

When I started applying the principles I learned from IMG, things slowly changed.

At first, it felt impossible. But with consistency, my financial life began to transform.

I built my emergency fund.

I got life insurance and healthcare protection.

I started investing regularly.

I learned how to budget with purpose.

And most importantly, I started teaching others.

It wasn’t about getting rich overnight — it was about becoming financially responsible and free.

Why IMG’s Mission Matters

The mission of the International Marketing Group is simple yet profound:

“To change people from spenders to savers, and from savers to investors — so that no family is left behind.”

This isn’t just a slogan. It’s a movement.

Every member becomes part of a global campaign for financial education.

Every seminar, every workshop, every sharing aims to empower ordinary people to take control of their money and their future.

Because the truth is, wealth isn’t only for the rich.

It’s for those who are willing to learn, discipline themselves, and start early.

The Four Pillars of Financial Freedom

Through IMG, I learned to build my financial foundation on these four pillars:

- Education:

Understanding how money works — learning about debt management, savings, insurance, investments, and retirement planning. - Protection:

Securing yourself and your family with healthcare and life insurance before you even start investing. - Accumulation:

Letting your money grow through disciplined investing, mutual funds, and long-term wealth-building tools. - Preservation:

Ensuring your wealth lasts — through estate planning, proper documentation, and financial literacy for your family members.

Without these four, everything else collapses.

Building Generational Wealth

The goal isn’t just to make money for yourself. It’s to create something that can outlast you.

When you learn and apply financial literacy, you’re not just changing your life — you’re changing the story of your family.

You’re teaching your children not to repeat your mistakes.

You’re giving them the chance to start ahead, not behind.

You’re breaking the cycle of poverty and dependency.

And that’s what true success looks like.

From Fear to Freedom

Today, I still work. But I work with peace of mind.

Because I know that no matter what happens — I’m protected, my savings are growing, and my future is secure.

I no longer live in fear of the next emergency or the next bill.

I live with purpose.

The same job that once only gave me income now gives me direction — because I learned to manage what I earn and make it work for me.

The Call to Change

If you’re reading this and you feel the same — tired, stuck, wondering why your hard work hasn’t paid off — know that you are not alone.

Many have been in your shoes.

And many have turned their stories around through financial education.

You don’t have to wait for a crisis to start learning.

You don’t need a high income to begin saving.

You don’t need to be an expert to start investing.

You just need to take the first step — to open your mind, learn the principles, and apply them one day at a time.

Because at the end of the day, the goal isn’t just to work hard.

The goal is to make your hard work count.

Final Thoughts

We live in a world where people are proud of being busy — but not enough people are proud of being financially wise.

It’s time to change that.

Working for years with nothing to show for it is not your destiny.

You can build something lasting — for yourself, for your family, for your future.

The journey starts with one decision: to learn.

Learn how money works.

Learn how to protect what you earn.

Learn how to grow your wealth wisely.

And when you do, you’ll finally see what all those years of hard work were meant to create — not just income, but freedom.

You don’t need to be rich to start. You just need to start.

Join the mission. Learn, build, and protect.

Because no family deserves to be left behind.